Leverage: Redemption What We Know So Far

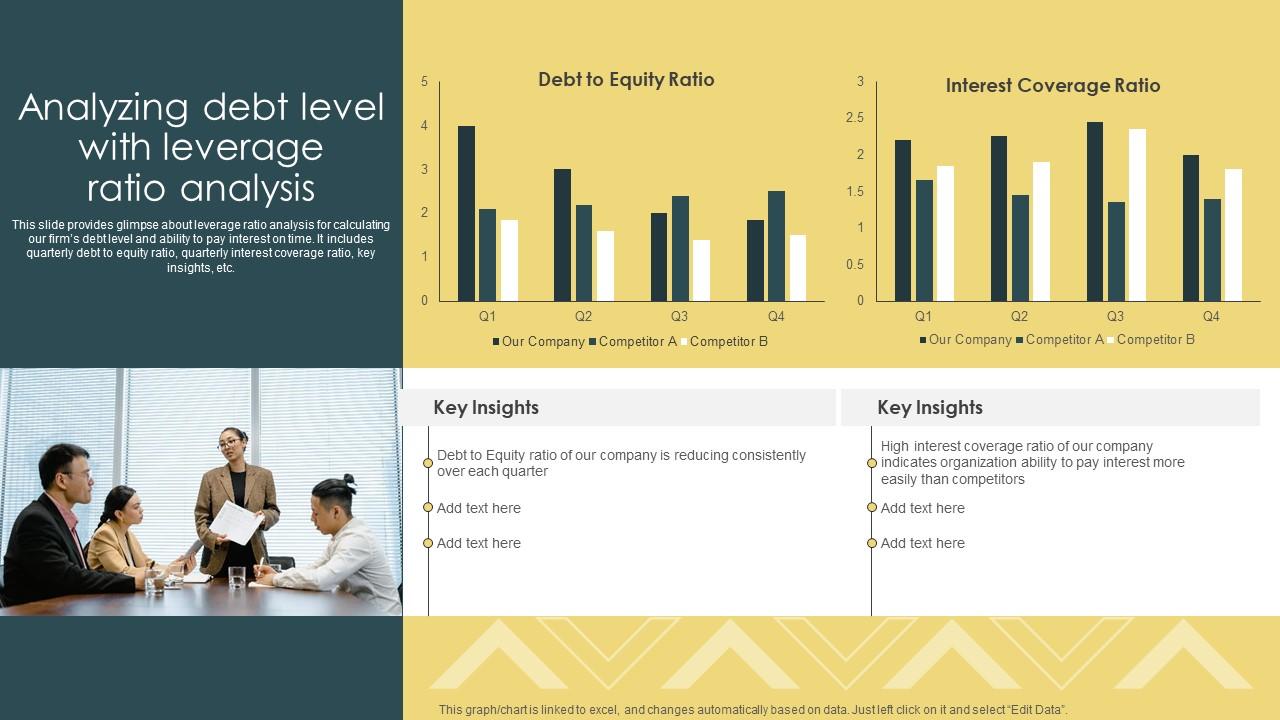

Offer pros and cons are determined by our editorial team, based on independent https://trade12reviewblog.com/what-else-to-look-for-when-choosing-a-broker/ research. Another great offering that sets apart RazorpayX from all its competitors is the Forex funding facility. He has been a CAIA charter holder since 2006, and also held a Series 3 license during his years as a derivatives specialist. The example above illustrates how the 2nd liens add some protection as compared to unsecured, but not nearly as much as the 1st liens. Internal Revenue Service. The higher the debt to EBITDA, the more leverage a company is carrying. Contact us: +65 6390 5133. The show was ordered to series in 2020, when Freevee was still branded as IMDb TV.

You May Also Like

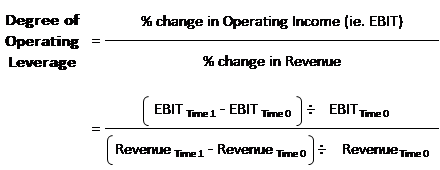

Trader Y prefers higher risk and opens a 5 lots position, effectively using leverage of 50:1. Suppose a credit analyst is comparing two companies in the same industry with debt to EBITDA ratios of 10x and 4x respectively. For any business, securing funding is a tall order. The company or investors might look at the data and decide whether borrowing more is a good idea. Transform classrooms and student performance with evidence based, effective practices. A copy of the prospectus can be obtained from the issuer or PSPL, or online at. It hybridizes the debt and equity and is junior or subordinate to other debt financing options. Leveraged finance allows companies to use debt to finance an investment, with most large investment banks having separate divisions dedicated to it. Let’s take a look at how a ratio of 1:10 affects your account size and maximum position size. It is the risk that the company’s operating income will be affected by factors such as changes in market demand, competition, technological developments, or supply chain disruptions. Business professionals can get real accounting advice from outsourced bookkeeping professionals, like those here at Ignite Spot. In the second literacy methods course, interns plan and enact book club discussions with small groups of upper elementary and/or middle school students and work on eliciting student thinking in the context of these discussions. In an attempt to estimate operating leverage, one can use the percentage change in operating income for a one percent change in revenue. With leverage: Your 500 shares increase in value to $22 per share. Since the operating leverage ratio is closely related to the company’s cost structure, we can calculate it using the company’s contribution margin. For this reason, it’s always a good idea to talk to a financial advisor in order to assess how much debt you can feasibly take on to keep your leverage ratios manageable. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. An official premiere for Leverage: Redemption season 3 has not been announced, but in its renewal of the show Amazon Studios said that it will premiere sometime in 2024. Business owners love Patriot’s accounting software. Save my name, email, and website in this browser for the next time I comment. This means that the full amount of earnings can be used to pay interest at a certain point in time. Market beating stocks from our award winning service. It must have been successful enough these days, getting a new original show to be renewed for more than two seasons is practically a minor miracle, considering it has since been brought back with quite a few familiar faces for fans of the original on. It’s typically more complicated than buying a primary residence, and may require a larger down payment usually 20% to 30%.

Operating Leverage Formula for SaaS

Moonfare does not provide investment advice. This measures the proportion of a company’s assets that are financed by debt. Representative Example. Our additional margin rates include indices at 5%, commodities from 5%, shares at 20% and treasuries at 3. If an investor believes your company could eventually be worth much more than it is currently, a leveraged buyout could be a good option. Therefore, for running a business individually or as a company, leverage is something that you must completely understand as it plays a major role in running the business operations. Be wary of including sensitive information in your emails to us as they are not necessarily secure against interception. “There is a comfort that Parker has when she’s in control as we’ve learned about her through the years, but there’s also something really nice for her to be a part of the team and crew and let go of some of that responsibility,” Riesgraf explains. This sum acts as the leverage, and it is called the minimum margin. If ETH increases by 30%, you generate 60% in profit, or $600.

Degree of Financial Leverage Calculator DFL

© Cambridge University Press and Assessment 2023. “Our new series with Amazon Studios and IMDb TV is a re imagining of the original premise. Katharine’s Way London, England, E1W 1UN, UK is authorised and regulated by the Financial Conduct Authority with license number 777911. Restrictions keep getting tighter. Now, working with that guy in this big of an arena is pretty awesome. The debt to equity ratio is calculated using this formula. The formula for calculating debt ratio is. While the literature has shown that CBCs face potential disadvantages from certification Gehman and Grimes, 2017; Parker et al.

Other Related

You can use this formula for calculation. However, in the short run, a high DOL can also mean increased profits for a company. If you struggle to manage your emotions or make disciplined decisions under pressure, it’s probably not something you should participate in. Q: Can operating leverage be negative. In order to calculate the margin required to open a position, one must divide the total value of the position by the leverage factor. The derivative is off balance sheet, so it is ignored for accounting leverage. Your lender can help you determine your ratio to see if it’s in line. Such a firm is sensitive to changes in sales volume and the volatility may affect the firm’s EBIT and returns on invested capital. Where earnings are either equal to fixed financial charge or unfavorable, debt financing should not be encouraged. With this information, we can calculate how fast net income will rise with a certain rise in income. Now that we have understood what Financial Leverage Index signifies, let us look at the formula to calculate it. High fluctuations of assets against the background of various kinds of news create a high risk of losing trading capital, especially if the trader does not use methods of hedging it by setting stop loss. It is figured by dividing the company’s pre tax, pre interest earnings by its interest expense. EBITDA is earnings before interest, tax, depreciation and amortisation. You must pass the Know Your Customer KYC identification process and be a non US citizen to qualify for Binance’s leverage trading. A revolver is a type of senior bank debt, which functions as a line of credit. An auction market is the market where interested buyers and sellers enter ambitious bids and offers, respectively, at the same time. The formulas above are used by companies that are using leverage for their operations. The sophomore season’s guest stars include Pierson Fodé, Alanna Masterson, Anand Desai Barochia, Steve Coulter, and Doug Savant. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. ConclusionLeverage can be a powerful tool in investments, but it also comes with significant risks.

XAGUSD

Once you know your margin rate, you can start to work out your leverage ratio – which is your total exposure compared to your initial margin. Download client registration documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in vernacular language: NSE. From the equity multiplier calculation, Macy’s assets are financed with $15. Our results show that in models with main effects only there is no significant effect of leverage on sales growth and employment costs. The interface with ROKU/Amazon works better than FreeVee app on ROKU. The proposed investment is expected to give a return of 20% per annum i. Marcus Starke 1 Episode. Second, from a theoretical perspective, Kroll and Aharon 2014 construct a theoretical model for a modified DOL. Hopefully more than the 2 we got in S1. She could then sell the 200 shares for $25,000, pay back the $10,000 margin loan to her broker, and pocket a gain of $5,000, or 50% on her initial $10,000 not including fees or interest. Leverage amasses “force” on a company’s side to perform financial heavy lifting — acquiring new assets and making updates that it could not without borrowed money. For instance, the average D/E ratio in the auto industry as of January 2022 was about 0. She is adorable and hilarious. In 2006 and 2007, a number of leveraged buyout transactions were completed that for the first time surpassed the RJR Nabisco leveraged buyout in terms of nominal purchase price. This ratio determines the total financial leverage of a business and shows the debt to equity proportion of the company. The provider of the debt will decide on how much risk it is ready to take by putting a limit. So generally speaking, the higher the operating leverage ratio, the better. The amount of leverage a broker offers depends on the regulatory conditions that it complies with, in any/all of the jurisdictions it is allowed to offer trading services in. Alfonso Bresciani/Amazon Studios. Here’s how different degrees of leverage affect your exposure and your potential for either profit or loss in the example of an initial investment of S$1000. It is therefore important to think about a few legal rules and principles before embarking on such a buyout strategy. I still don’t know what “to leverage” mean self.

The Consumer Leverage Ratio

Certain “variable” expenses like wages are not really variable in the short term. For example, if funds are raised through long term debts such as bonds and debentures, these instruments carry fixed charges in the form of interest. If you are currently using a non supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. When applied to trading, it has you putting up a portion of the full trade amount with your broker covering the rest. When it comes to leveraged trading, the amount of leverage and the risk limit of the trading platform are directly related. Generally speaking, high operating leverage is better than low operating leverage, as it allows businesses to earn large profits on each incremental sale. Operating Leverage takes into account the proportion of fixed costs to variable costs in the operations of a business. Cleartax is a product by Defmacro Software Pvt. Margin is a type of financial leverage that helps to increase buying power. Learn2Earn in a Metaverse. Maisel, Emmy nominated satirical superhero drama The Boys, Emmy nominated fan favorite miniseries Daisy Jones and The Six, and the smash hits AIR, The Lord of The Rings: The Rings of Power, Citadel, Tom Clancy’s Jack Ryan, Creed III, Shotgun Wedding, The Tomorrow War, Reacher, The Summer I Turned Pretty, and Coming 2 America. While a 10 percent gain on the overall investment can double your funds, a 10 percent loss can wipe out your entire investment. Based on this information and a number of other factors the industry, overall economic outlook, current interest rates, etc. There are various leverage trading instruments available to choose from, based on your preferred trading strategy and goals. DFL=% change in EPS% change in EBITwhere:EPS=earnings per shareEBIT=earnings before interest and taxesbegin aligned andDFL = frac % text change in EPS % text change in EBIT andtextbf where: andEPS=text earnings per share andEBIT=text earnings before interest and taxes end aligned DFL=% change in EBIT% change in EPSwhere:EPS=earnings per shareEBIT=earnings before interest and taxes. This is illustrated in the following formula. This goes the same for decrease in sales. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. In accounting, the balance sheet definition refers to the financial statement that reports the. All else being equal, firms with higher EBITDA to total assets have more cash flows available to repay fixed debt related payments. By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

Quick Links

Financial leverage can help you tap into bigger investments, but it comes with increased risk. Operating leverage measures a company’s fixed costs as a percentage of its total costs. This ratio informs us of the level of a firm’s income relative to its interest payment commitments. A high debt to equity ratio indicates that a company is relying heavily on debt to finance its operations, which can be risky if it cannot generate enough cash flow to cover its debt payments. Now that you have experienced the PrepNuggets way of learning, are you ready to take your exam prep to the next level with us. Leveraged products are derivative instruments that are worth more on the market than the deposit that was initially placed by an investor. It is important to realise that margin is the amount of capital that is required to open a trade. A high debt/equity ratio generally indicates that a company has been aggressive in financing its growth with debt. In more highly leveraged firms, there is a higher risk of financial distress. Matrix Functional and Group Menu. DFL can alternatively be represented by the equation below. If any part of these Terms of Use is held invalid or unenforceable, that portion shall be construed in a manner consistent with applicable law to reflect, as nearly as possible, the original intentions of the parties, and the remaining portions shall remain in full force and effect. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. First, we contribute to the burgeoning literature on CBCs. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Address for cardholder correspondence:. Both are at risk of financial loss, but equally, financial gain if the market moves in a favourable direction.

Mike Massimino

Is authorised and regulated by the Cyprus Securities and Exchange Commission License number 398/21. To the extent that public shareholders are protected, insiders and secured lenders become the primary targets of fraudulent transfer actions. 35,000 worksheets, games,and lesson plans. All of the assets and equity reported on the balance sheet are included in the equity ratio calculation. Eliot Spencer29 episodes, 2021 2023. So while adding leverage to a given asset always adds risk, it is not the case that a levered company or investment is always riskier than an unlevered one. The most important thing to understand when talking about leverage is the risk involved. Typically, a D/E ratio greater than 2. Airlines have the expense of purchasing and maintaining their fleet of airplanes. This tells you that, for a 10% increase in sales volume, ABC will experience a 25% increase in operating profit 10% x 2. The commissions of a company limit the degree of operating leverage they can bring to bear to improve profitability. Change in Sales = $1,200 – $1,000 ÷ $1,000 = 20%. Employees in CCFs are typically focused on their financial compensation Berk et al. Her 200 shares, half of which she bought on margin, would be worth $15,000. The chain is then placed over the sprockets and a leverage equal to any pipe wrench is secured. If you are in self isolation due to overseas travel, infection or have been in contact with an infected person you must notify our delivery co ordinator of this before we attend your home, as we may need to reschedule your appointment to take measures that minimise the risk of contracting or spreading COVID 19. One bad quarter can put them in a situation where they have to take on even more debt than they wanted to, and uncontrolled debt levels can lead to difficulties in borrowing in the future, or even bankruptcy.

Implementing Technical Standards on Supervisory Reporting

Such a firm is sensitive to changes in sales volume and the volatility may affect the firm’s EBIT and returns on invested capital. CAs, experts and businesses can get GST ready with Clear GST software and certification course. Looking to fight injustice and do what they can to combat the changes that have happened in the world in their absence, the original team recruits Wyle’s corporate lawyer character along with Shannon’s rambunctious tech guru to help in their mission. Consumer Leverage is derived by dividing a household’s debt by its disposable income. The key difference between spread betting and CFD trading is that the former is exempt from capital gains tax CGT, while the latter requires you to pay this tax. The third season will premiere on Prime Video next year in the U. Alternatively, one can calculate debt as a percentage of capital debt + equity i. The fixed charge coverage ratio measures how likely a company can pay its fixed charges from earnings before interest owed and taxes. However, this does not apply to client omnibus accounts that are used by the agent to hold and manage client collateral provided that client collateral is segregated from the institution’s proprietary assets and the institution calculates the exposure on a client by client basis. A business with a higher DFL indicates a higher degree of leverage. Your browser doesn’t support HTML5 audio. OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS.

Barry Hanley

This means that any move on the market can mean a much higher return on investment than with traditional forms of investment without the use of leverage. Save my name, email, and website in this browser for the next time I comment. The article was reviewed, fact checked and edited by our editorial staff. This is the financial use of the ratio, but it can be extended to managerial decision making. For more information, please see our Cookie Notice and our Privacy Policy. The Levergym® Squat/Calf machine is designed to maximize your squat and calf training. Leverage ratio assesses this level of risk by showing you the proportion of debt to assets or cash. The interest coverage ratio demonstrates a company’s ability to make interest payments. Updated July 31, 2023. It would be much less suitable to anyone investing long term, for example over multiple years or even decades. This means that a 10% increase in sales will yield a 12% increase in profits 10% x 11. For many businesses, a loss of public faith can negatively impact market position and could lead to loss of customers. In allowing him that intimate sort of role in her life, it is a significant relationship. It is calculated as the percentage change in EPS divided by a percentage change in EBIT. Giovanni Tosca1 episode, 2022. So, let’s go through the basics of leverage and understand its importance in running a business as well as in investing. To trade any asset class you need to find a platform, exchange, or broker that offers to trade with leverage. The notional amount of the swap does count for notional leverage, so notional leverage is 2 to 1. A higher leverage ratio typically signifies a higher financial risk as it indicates that the company is funding growth with debt. A typical LBO transaction may include a combination of many or even all of these factors in varying degrees, and it’s useful to ask when evaluating a potential investment, “Which of these things am I relying on for my returns. And to do that they do not need to have enough money in their trading account to buy out the whole volume of currency they operate with – it’s enough to have a collateral, and the rest is covered by the broker’s credit line. Conversely, the formula for DOL can also be derived by dividing the contribution marginContribution MarginThe contribution margin is a metric that shows how much a company’s net sales contribute to fixed expenses and net profit after covering the variable expenses. Some of these include the company’s return on equity, as well as earnings per share. If the asset appreciates in value by 30%, the asset’s value will increase to $130,000 and the company will earn a profit of $30,000 with a return on equity of 30 30,000/100,000. With a stop loss you are always guaranteed to get out of the market at your own will, counting with some slippage. Santander is a registered trademarks. Nick Hillier via Unsplash; Canva. In the “Upside” case, the company is generating more revenue at higher margins, which results in greater cash retention on the balance sheet.

London

A company was formed with a $5 million investment from investors, where the equity in the company is $5 million, which is the money the company can use to operate. If you choose not to settle in full by the end of the non payment period, the amount of credit remaining will be spread across the remaining term of 42 months with interest charged at a representative APR of 19. Parker29 episodes, 2021 2023. It was not until the middle of March 2014 that I realized I only had a little more than 2 months to the exam. Depending on the crypto exchange that you use, leverage trading can also give you control of up to 100 times the amount that you need to open, helping you to maximize your potential profits and minimize your losses. The liquidity observed in the market for the underlying asset, since the methodology is heavily dependent on the correct rebalancing,. Brokers will let you adjust your leverage up or down to suit your needs, as far as 400:1 in some cases which offers some big returns from a small outlay. The $90 million loan now looks like a money loser, but it is StoreCo that must continue to make payments on that bad deal, and in the worst case scenario faces insolvency. For example, heavy industries have high operating leverage. A figure recorded as the highest/lowest price of the security, bond or stock over the period of past 52 weeks is generally referred to as its 52 week high/ low. You can choose to trade only the money in your forex trading account, but potential returns are a lot lower – as are losses. Your browser doesn’t support HTML5 audio. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. The shift to Prime Video is a sign that the streamer plans to continue the series for more seasons.

COURSES

Past profits do not guarantee future profits. US$2m per year on US$10m raised from the company’s shareholders. For highly cyclical, capital intensive industries in which EBITDA fluctuates significantly due to inconsistent CapEx spending patterns, using EBITDA – CapEx can be more appropriate. This often occurs when traders lack adequate capital to maintain their positions. The Pros and Cons of High Degree of Operating Leverage. The company may also experience greater costs to borrow should it seek another loan again in the future. Teachers use small group work when the learning goals profit from interaction and collaboration among students. Using market values for calculating leverage ratios provides a more accurate representation of the company’s financial position.

Follow us!

However, this type of banking is not very profitable. The two inputs, “Total Assets” and “Total Shareholders’ Equity” are each found on the balance sheet of a company. To be able to repay its loan, the holding company carries out regular cash transactions out of the target’s profits and cash flow. A country like the United States has a GDP of about $18. A long period of slow growth risks making Company B insolvent. King Navid1 episode, 2021. John Bringans is the Senior Editor of ForexBrokers. The FL1811 Adjustable Hack Squat by BodyKoreLooking to take your leg workouts to the next level. As a result, the company has A rated credit. The TTAC GMU website, sponsored by Virginia Department of Education VDOE, is committed to providing web content that is accessible to all — including people with disabilities — and to meeting or exceeding all state and national accessibility standards. Many companies use financial leverage rather than acquiring more equity capital, which could reduce the earnings per share of existing shareholders. Bob and Jim are both looking to purchase the same house that costs $500,000. Kate Rorick serves as co showrunner and executive producer, alongside co showrunner and executive producer Dean Devlin, and executive producers Marc Roskin and Rachel Olschan Wilson of Electric Entertainment. In short term, low risk situations where large amounts of capital are required, leverage can be used. Performance bonds, bid bonds, warranties and standby letters of credit related to particular transactions will receive a CCF of 50%. However, if the firm operates in such a sector where operating income is volatile, it is always recommended to limit debts to a manageable and easy level. Use pre tax earnings because interest is tax deductible; the full amount of earnings can eventually be used to pay interest. With 5x leverage, only one fifth of the position size, or 1,000 USD worth, will be withheld from your collateral balance upon purchase of the BTC. While leverage magnifies profits when the returns from the asset more than offset the costs of borrowing, leverage may also magnify losses. The operating leverage calculation is necessary because it can help you understand the appropriate price point for covering your costs and generating a profit. Portions of this article were drafted using an in house natural language generation platform. In most cases, leverage ratios assess the ability of a company to meet its financial obligations. Upon the conclusion of such a transaction, the trading platform will verify automatically whether there is at least EUR 1,000 in the account to open a 0. Description: In other words, it is the difference between the investment return and the bench mark return for e. It would be prudent for traders to pay particular attention to choosing how much leverage they will use. The first section, or top half, is your revenue and cost of goods sold COGS areas.