ICICI Lender is one of the most recognized banking and monetary properties enterprises in the India. The bank now offers several financial services, and mortgage brokers, playing cards, coupons and you can newest profile, both for resident Indians and you will NRIs. NRIs may home loans in the sensible interest levels for a good kind of purposes, for example on the acquisition of a property, a separate family or build of a property in India, depending on their own demands. ICICI NRI financial is created specifically to own Indians way of living abroad getting employment, education and company purposes, as well as seller navy personnel. Here are the possess, qualification standards and interest rates off ICICI Lender NRI home loan.

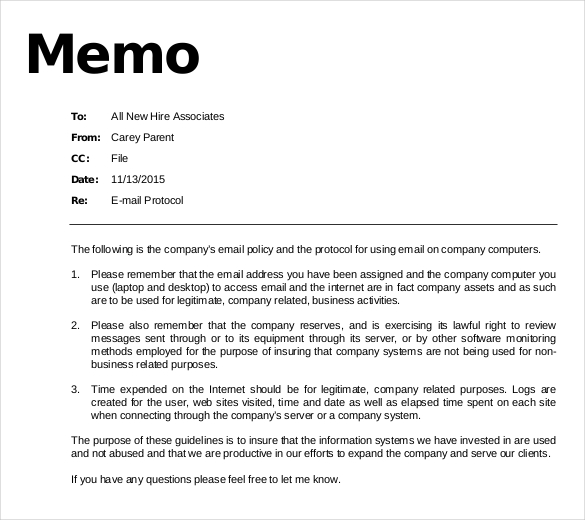

Data files You’ll need for NRI Financial by the ICICI Bank

This is the record regarding data one NRIs will have to show to try to get ICICI Lender NRI mortgage:

- 1 notice-attested passport proportions newest pic of any applicant (applicant & co-applicant)

- Backup out-of appropriate passport

- Content out of appropriate charge or works allow

- Running payment cheque / write inside INR getting fees out of NRE/NRO/to another country salary account of customer in favor of ICICI Lender

- Power out of Attorneys properly signed by the candidate and you may co-applicant, or no

- Authority letter properly signed by all the candidates

- Business facts

- Content from Dish Cards of the 1st candidate ot Setting 60

Great things about ICICI Lender NRI Home loan

At the SBNRI, we let NRIs to order, sell otherwise rent services from inside the Asia without the stress. Fill this form locate almost any a residential property services.

ICICI NRI Mortgage EMI calculator

ICICI mortgage EMI calculator on the net is an electronic digital equipment one to support pages to determine the brand new monthly payment they usually have and then make to invest right back the house loan. ICICI home loan calculator is straightforward to make use of and you may screens direct performance according to research by the enters in a matter of seconds. Input home loan components for example prominent loan amount, rate of interest and you will financing tenure to your calculator to get into their ICICI NRI home loan EMI.

You can get in touch with our pro right on WhatsApp with the button less than to answer your own doubts and you may concerns. Also visit the writings and you will Youtube Station elitecashadvance.com legitimate bad credit loan for more info.

Faqs

Good co-candidate isnt compulsory to get a mortgage from ICICI Financial. But not, a personal guarantor required when there is zero co-applicant. The new co-candidate tends to be an enthusiastic NRI otherwise a resident Indian.

ICICI Bank also offers various financial strategies for different tenures. Variety of ICICI lenders is given that below:Home loan getting home: To the buy, build, expansion otherwise restoration of another type of apartment or home. You can purchase financial support as much as 80% of the home value for a loan number as much as Rs. 20 lakh otherwise around 70% off value of to have loan > Rs. 31 lakh. Salaried people will get that loan for approximately 15 years and self-utilized for up to 10 years.Financial to possess parcel of land: To your acquisition of a block of land to own residential use. The spot need to be found inside civil restrictions. A loan amount as much as 75% of total cost out of possessions if there is direct allotment from development expert, or over in order to 65% of your own total cost in case there is allowance away from a builder. Susceptible to maximum regarding INR 50 lakh. Limit tenure is actually ten years for salaried and you may mind-working applicants.

ICICI NRI financial installment you could do when you look at the EMIs (Equated Month-to-month Instalments). Consumers is question post-old cheques using their NRE/ NRO membership, or other levels approved by the Set aside Bank regarding India.

Yes, ICICI Bank allows foreclosures of home financing before end of the financing tenure. Complete prepayment was subject to a foreclosure fees out of dos% on the the matter and also the matter paid in the last 1 year.

Zero, you don’t need to see India so you can avail home financing. NRIs are able to use Fuel regarding Lawyer (POA) to get home financing when you look at the India. Otherwise label ICICI Financial customer care to know way more.

One Indian resident designated to act for NRI applicant(s) from delivery out of Standard Energy away from Attorney (GPA) deed. It is compulsory for candidate(s) to perform the GPA in favor of the person worried. In the event your co-candidate are a citizen Indian the guy/she will be able to function as the Stamina regarding Attorneys using GPA performance of the the main borrower.