Initial & critical phase during the done Loan servicing. The latest Loans Industry is now progressing its run Customer wedding & Satisfaction to the areas of build & beginning one to fulfils customers’ standards very first.

Nowadays, this action is fully automatic with the aid of a tip system & API integrations with Credit reporting engine’s (CIBIL, EXPERIAN etc

For pretty much all of the lender the definition of the definition of Mortgage origination differs in which it begins, different degrees for the procedure and in which it stops. All of the Loan style of are certain to get a different sort of approval procedure that normally getting manual or automatic. Lenders enjoys its miracle sauce regarding Mortgage Origination which they never must display because Mortgage origination is what makes Businesses stand out from the competition. Financing Origination System is guilty of controlling anything from pre-certification on recognition from capital the mortgage.

Here is the first faltering step regarding Mortgage origination processes. At this point, the potential debtor will get a list of situations they require add toward bank to acquire that loan. This may were :

- ID Facts / Address evidence: Voter ID, AADHAR, Dish Credit

- Latest A position Advice along with Paycheck sneak

- Credit rating

- Lender report & Earlier Financing Statement

Once this data is published to the financial institution, Financial critiques new data and you can a beneficial pre-recognition is established, making it possible for new borrower to keep along the way to get a beneficial mortgage.

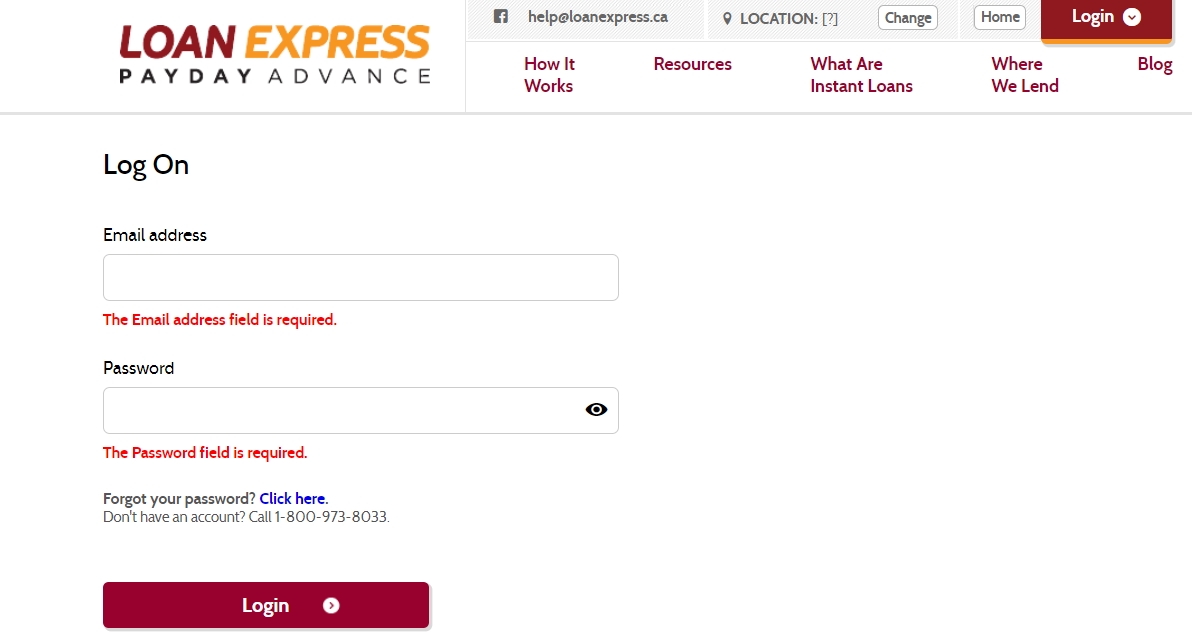

This is actually the next stage of financing origination processes. Contained in this stage, new borrower finishes the borrowed funds software. Either this app is going to be report-situated, but now lenders are moving on on the a digital adaptation which makes it stage Paperless. The innovation allow it to be finishing the application form online as a result of webpages & mobile software, and you may collected analysis will be designed to certain financing circumstances.

At this point, the application are obtained from the credit agency plus the basic step accomplished by this new service is always to opinion it for reliability, legitimate & Completeness. When the all of the necessary industries aren’t accomplished, the application form would-be returned to the fresh new debtor and/or borrowing expert and they’ll extend the brand new debtor in order to procure the newest shed guidance.

Lenders have fun with Financing ORIGINATION System (LOS) to understand the latest creditworthiness of your consumers. It will immediately banner data files which have missing needed fields, return it toward individuals and you will notify sales/Borrowing agencies in order to rework. Depending on the team & product, different processing is part of so it phase.

Whenever a credit card applicatoin is totally completed, the new underwriting process initiate. Today Financial monitors the program getting multiple parts on the account: credit score, chance results, and lots of lenders generate their own conditions getting rating you to definitely is novel on their business or community. ) inside the LOS. In the a guideline system, the lender is also stream underwriting advice particular so you’re able to activities.

A LOS will assist a lender setup workflows in order to techniques financing

With regards to the comes from the underwriting process, a software might possibly be recognized, denied otherwise delivered back into the inventor for additional information. When the particular criteria’s usually do not fits depending on the signal engine place regarding the system, there clearly was an automatic improvement in the latest variables, such as for example shorter loan amount or some other interest levels.

Just like the financing is extremely regulated, the standard take a look at stage of your mortgage origination process is essential in order to lenders. The applying is distributed into quality assurance class, you to definitely get acquainted with crucial parameters facing external and internal rules and regulations. This is basically the history go through the app earlier goes to investment.